Spread is the difference between an asset's buy (offer) and sell (bid) prices. The spread is how CFDs are priced. Spreads are used by many brokers, market makers, and other suppliers.

This means the price to buy an asset will always be higher than the underlying market, and the price to sell will always be lower.

Spread is the difference between two prices or rates in finance. It's also an option spread trading method.

Buying and selling options with varying strike prices and expiration dates. Many new traders ignore spreads.

This post explains market spread and how it might ruin an excellent trade.No matter what financial instrument we trade, we need a willing counterpart to purchase or sell the asset to us.

The market facilitates buyer-seller transactions. Supply and demand determine asset price. Even liquid markets have bid and ask.

Ask price is the lowest price market participants are willing to sell you an asset, while the bid price is the highest price they'll pay.

Bid and ask rarely match. Spread is the disparity. Market liquidity affects spread size. Higher liquidity means more trade volume and market participants, making exchanges easier.

Spreads are lower in such marketplaces. Less liquid marketplaces have low trade volumes, making it harder to locate an exchange counterpart. Such markets have significant spreads.

Spreads must be factored into a trade's risk-to-reward ratio. High spreads can ruin trade for scalpers and day traders. Before trading, verify spreads.

In 2020, UK/NY Gold spreads were extremely high. High spreads prevented me from trading for a few days.Not considering spreads would cost you money.

Exactly what is the bid-offer spread?The term "spread" used to describe the spread applied to an asset's price is "bid-offer spread," which is sometimes referred to as the "bid-ask spread.

"The supply and demand for an asset are represented by the bid-offer spread. There is an agreement between buyers and sellers as to the value of the asset if the bid and offer prices are close together, which is a sign of a tight market.

There is a considerable variation in opinion if the dispersion is wider. There are many variables that might affect the bid-ask spread, including:

Liquidity

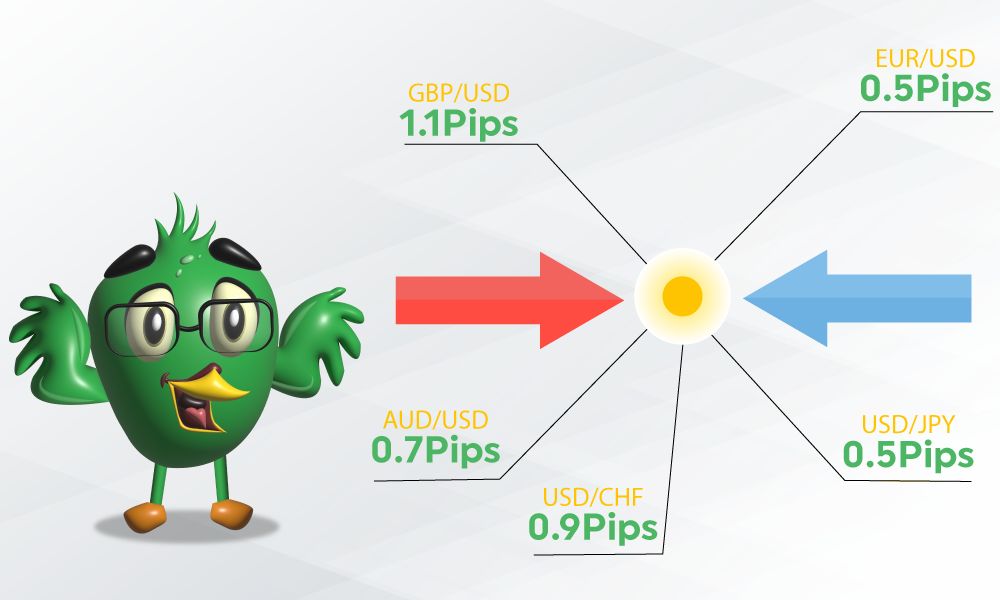

The ease with which an asset can be purchased or sold is referred to as liquidity. The bid-ask spread normally narrows as an asset's liquidity rises.

Volume

This is a way of reporting how much of an asset is traded per day. Higher trading volume assets typically have closer bid-offer spreads.

Volatility

This gauges how much the market price fluctuates over a specific time frame. The spread is typically much greater when prices are volatile and changing quickly.